Before diving into the details of overfitting, it’s important to understand the broader context of backtesting and optimizing trading strategies. If you’re looking for a complete guide on how to perform backtests and optimize strategies using cTrader, check out our Complete Guide to Backtesting and Optimization on cTrader. In this article, we’ll focus on overfitting, a crucial concept that occurs when a strategy is too closely fitted to historical data, showing great past results but underperforming in future markets. We’ll explore what overfitting is, how to recognize it, and how to avoid it to ensure your strategies remain robust in real market conditions.

What is Overfitting?

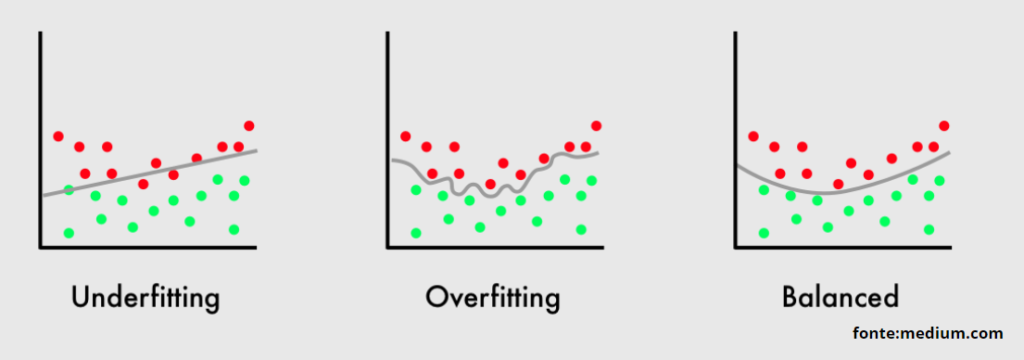

Overfitting happens when a trading strategy is designed to fit historical data perfectly. This often occurs when a trader excessively optimizes the strategy parameters to achieve maximum profit during the backtest, tailoring the strategy to every minor detail of historical data. The primary problem is that this data includes noise, which refers to random market movements unrelated to systematic patterns.

When a strategy is overfitted, it becomes too specific and loses the ability to adapt to changes in real market conditions, where conditions are never exactly the same as the past.

How to Recognize Overfitting

There are several signs that may indicate an overfitting problem during backtesting:

- Excessively high performance in backtesting: If a strategy shows extraordinary results in the past, it may have been too closely fitted to the specific historical data.

- Overly complex model: Strategies with too many parameters or complex rules are more likely to overfit, as they try to adapt to every single detail in the historical data.

- Worse performance on out-of-sample data: When the strategy is applied to data not used in the optimization process (out-of-sample data), performance may drop significantly compared to the backtest results.

How to Avoid Overfitting

- Use out-of-sample data and walk-forward testing: It’s essential to test the strategy on data that wasn’t used in the original backtest. This process can be done using methods like walk-forward testing, which divides historical data into test and optimization segments, evaluating the strategy on periods not used during the optimization.

- Keep it simple: Strategies with fewer parameters are generally more robust. A good rule of thumb is to keep the model as simple as possible, avoiding the introduction of too many elements that risk being overly fitted to past data.

- Test in different market conditions: A strategy should be tested over various historical periods, including bullish, bearish, and sideways markets. This helps verify whether the strategy is robust in different market conditions, reducing the risk of overfitting to a single scenario.

- Use cross-validation: Similar to walk-forward testing, cross-validation splits the data into segments to train the strategy on one part and test it on another. This helps ensure that the strategy isn’t just performing well on specific historical data but can work on new data as well.

Optimization Strategies and Overfitting

Optimization is an essential process for improving the performance of a trading strategy, but if done incorrectly, it can easily lead to overfitting. Here are some optimization techniques to reduce the risk of overfitting:

- Grid Search and Random Search: These methods allow you to explore different parameter combinations without focusing too much on a single configuration ideal for historical data. Grid Search systematically tests every possible combination, while Random Search performs random tests within a parameter range.

- Walk-Forward Optimization: This method optimizes parameters for a specific period and then tests the strategy on a subsequent new period. This repeated approach ensures the strategy is continuously evaluated on fresh data, limiting the risk of overfitting.

Overfitting is one of the main risks associated with backtesting trading strategies, as it can provide a false sense of security about the strategy’s results. However, by adopting proper testing techniques, using out-of-sample data, and carefully optimizing parameters, you can significantly reduce this risk, developing trading strategies that are robust and perform well even in unpredictable market conditions.

Investing time in preventing overfitting during the backtesting phase is a crucial step to ensure that your trading strategy can succeed in the real world.