Backtesting is a crucial step for any trader who wants to evaluate the effectiveness of their trading strategies. In this Complete Guide to Backtesting and Optimization on cTrader, you’ll discover how to leverage the advanced tools and high-quality historical data offered by cTrader to make informed decisions and improve real-time trading performance.

What is Backtesting?

Backtesting is a process that simulates a trading strategy using historical data to assess its profitability and potential risk. cTrader offers an intuitive interface and powerful tools to perform detailed and accurate backtests.

Advantages of Backtesting on cTrader

- Strategy Optimization: The ability to improve and refine strategies based on the results obtained.

- Accurate Historical Data: Access to market data that reflects real past conditions.

- Advanced Features: Flexible tests that allow for in-depth analysis of strategies.

How to Run a Backtest on cTrader (version 5.0.37): Step-by-Step Guide

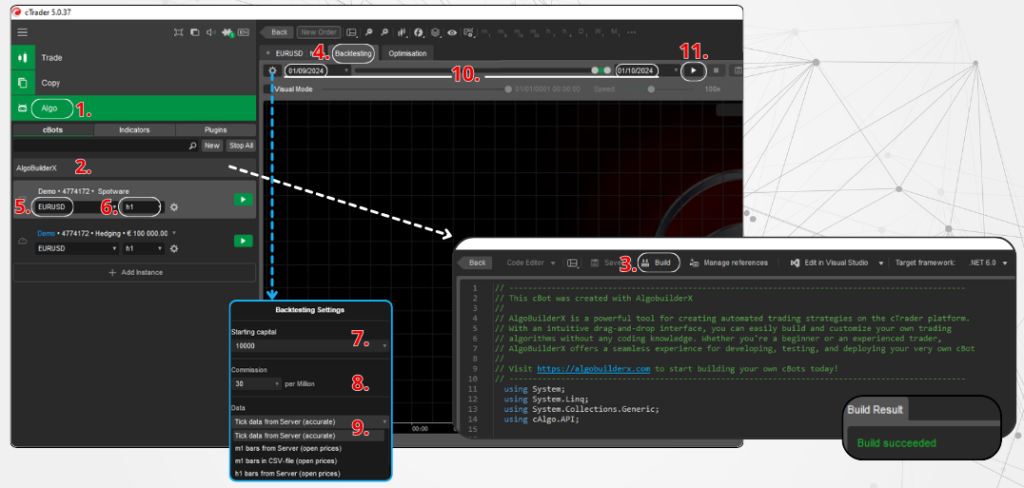

Access cTrader Algo

- Open cTrader and select the “Algo” tab.

- Program or import your trading strategy in .algo format.

- Click “Build” to verify the code and eliminate any errors.

- Return to the main page and click “Backtesting” above the chart to enter cTrader’s backtesting section.

Set Up the Backtest

5. Pair: Choose the currency pair to test.

6. Time Frame: Select from minute, hourly, or daily intervals.

7. Starting Capital: Set the initial capital for the test.

8. Commissions: Include transaction costs in the final calculation.

9. Data: Choose from several options:

- Tick data from server: Maximum accuracy (OnTick) as the backtest follows the past spread.

- M1 bars from server: Executes the test OnBar at the close of each 1-minute candle, where the strategy’s actions are performed.

- M1 bars in CSV-file: Allows the import of external data in CSV format.

- Time Frame bars from server: Test based on the selected Time Frame OnBar.

Start the Backtest

10. Choose the duration of the backtest.

11. Click “Play” to start the backtest and monitor the results.

Key Metrics to Analyze

cTrader provides a series of results to evaluate your strategy, with some of the most important being:

- Total Commissions: Calculates the transaction costs incurred.

- Profit/Loss: The overall effectiveness of the strategy.

- Drawdown: The risk measured by the maximum drop in capital or equity.

- Win/Loss Ratio: Number of winning and losing trades compared to the total trades made.

Optimization of Strategies on cTrader

Optimizing strategies is crucial to fine-tune parameters and improve trading performance. cTrader allows you to run tests on multiple parameters simultaneously, enabling you to find the most effective combinations.

1. Parameter Optimization

- Single Parameter Optimization (Walk-Forward Optimization): Optimize one parameter at a time to understand the impact of each on performance.

Read the article: Walk-Forward Optimization: A Dynamic Approach to Backtesting - Multi-Parameter Optimization: After optimizing parameters individually, move on to simultaneous optimization to discover possible interactions between parameters.

2. Time Frame for Backtesting

- Long-Term Testing: A 5-year period is preferable to a 1-year period because it covers various market conditions, such as bullish, bearish, and volatile phases. This helps to evaluate the robustness of the strategy in different scenarios, making it more reliable over the long term.

- Data Segmentation: Breaking down data into segments, like annual tests, allows you to check the strategy’s consistency over time. This approach helps identify any weaknesses that could emerge in specific market conditions, ensuring more stable performance.

3. Optimization Schemes

- Avoid Overfitting: Do not overly adjust the strategy to historical data. Use “out-of-sample” data to validate results on untested periods.

Read the article: How to Avoid Overfitting in Backtesting Trading Strategies on cTrader: A Complete Guide. - Grid Search and Random Search: Use parameter search methods such as Grid Search or Random Search to explore various combinations without testing every single scenario.

Read the article: Grid Search and Random Search in Backtesting Trading Strategies on cTrader