In the world of forex trading, understanding the correlations between different currency pairs can offer significant advantages. Currency correlations show how two currencies move in relation to each other. These movements can be used to diversify trading strategies and reduce the overall risk of the portfolio.

What is Currency Correlation? The correlation between currency pairs measures the degree of relationship between the price movements of two currencies. This correlation can be positive or negative:

Positive Correlation: Two currency pairs move in the same direction. For example, EUR/USD and GBP/USD tend to have a positive correlation because both the euro and the pound may appreciate or depreciate against the US dollar based on similar economic factors.

Negative Correlation: Two currency pairs move in opposite directions. For example, USD/JPY and EUR/USD often show a negative correlation, as the US dollar may move in different directions relative to these currencies.

Advantages of Strategies Based on Correlations Risk Diversification: Using currency pairs with negative or low correlations can help balance the portfolio and reduce exposure to sudden market movements. Expansion of Trading Opportunities: Currency correlations allow for the discovery of a wide range of trading opportunities. Exploiting temporary discrepancies to open new positions can maximize profits, anticipate market movements, and gain a competitive edge. Confirmation of Trading Signals: Correlations can be used to confirm trading signals. For example, if EUR/USD and GBP/USD show similar signals, it could strengthen the decision to enter a position.

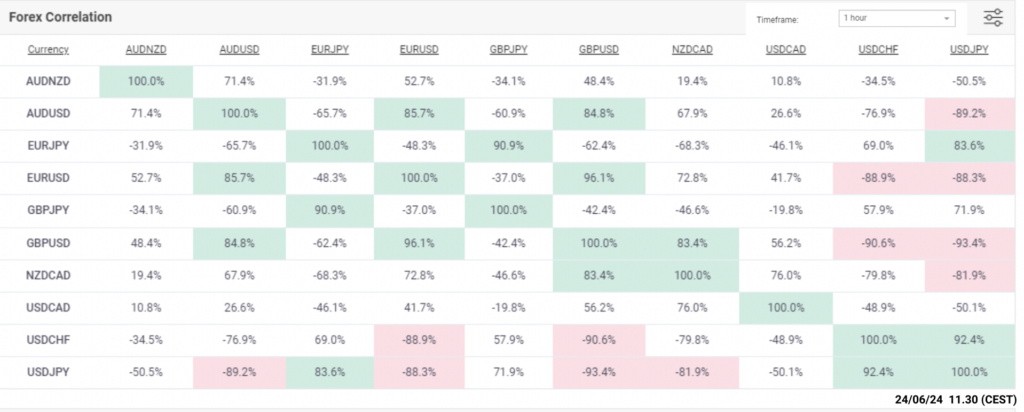

How to Create Strategies for Correlated Currencies with AlgoBuilderX Correlation Analysis: Use analysis tools to calculate historical correlations between different currency pairs. Identify pairs that show significant correlations. For example, you can consult Myfxbook for updated currency correlation data.

Source: Myfxbook Correlation Data

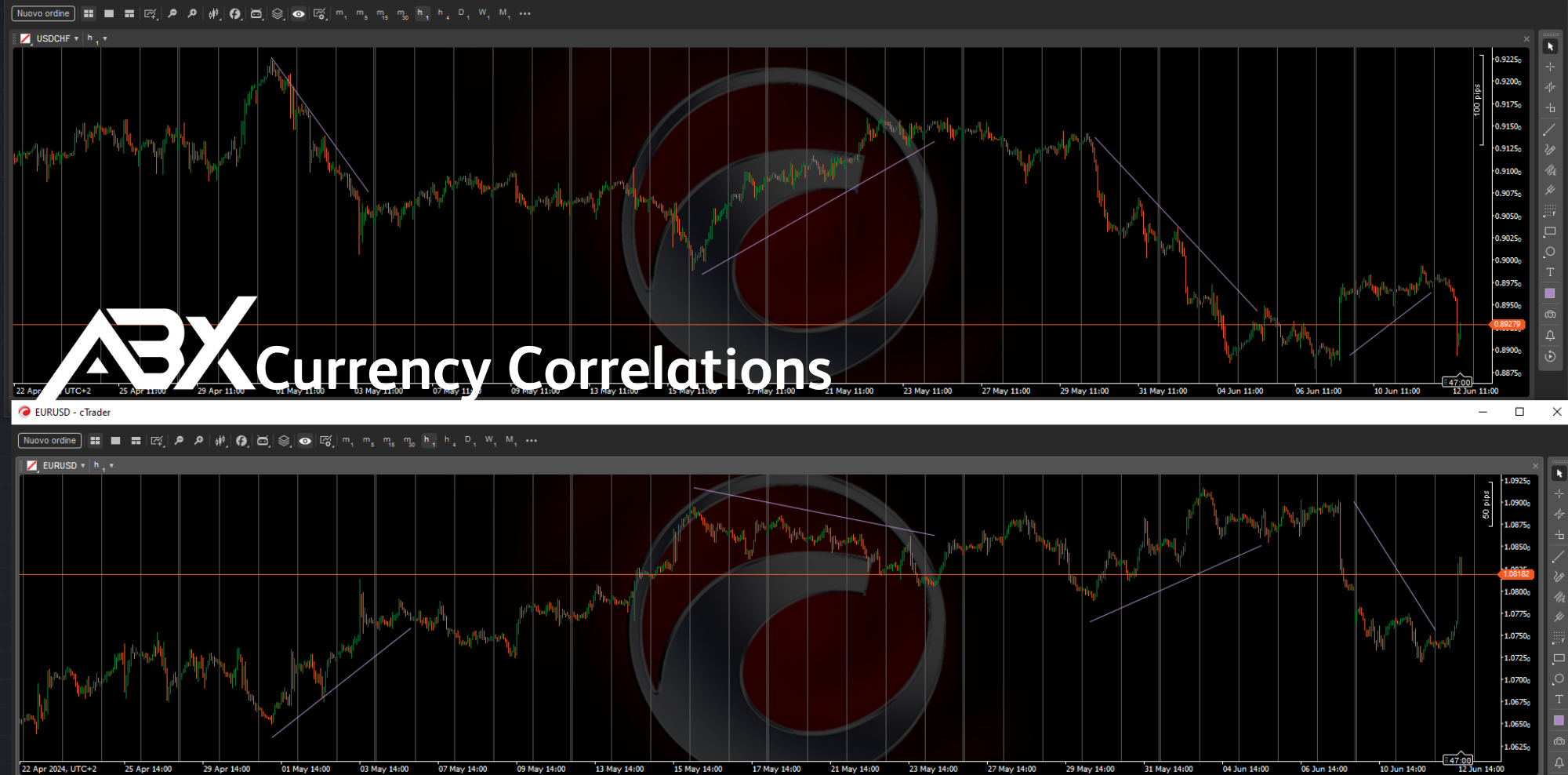

Algorithm Development: Develop algorithms with AlgoBuilderX that take currency correlations into account. For instance, you can create an algorithm that opens long positions on EUR/USD and short positions on USD/CHF when the negative correlation between these pairs is strong.

With over 70 indicators provided by cTrader, AlgoBuilderX helps you identify the best moments to enter or exit the market using technical indicators like RSI, MACD, Bollinger Bands, and many others to strengthen your correlation-based trading strategies.

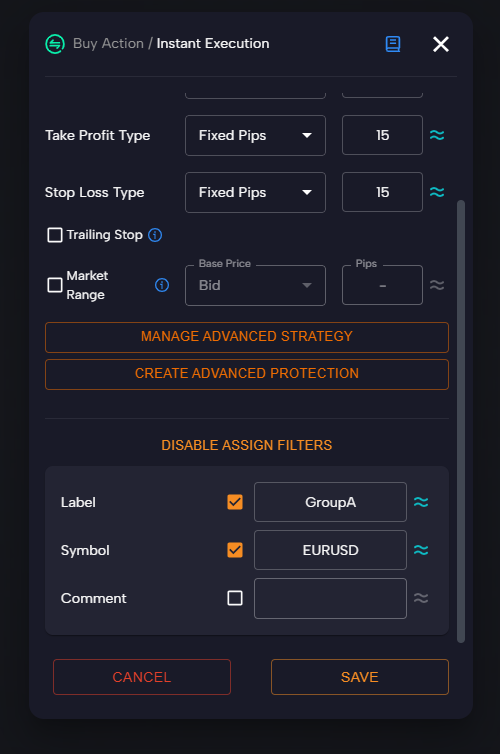

Filters and Conditions: Use the “SYMBOL” filter to filter condition or order execution blocks only for a specific currency. This allows you to create complex strategies by dividing blocks based on currencies, facilitating the creation of correlation strategies between two or more currencies.

Trade Management: You can manage trades based on groups with the “label” filter. This allows you to manage groups of trades, which is useful for complex strategies involving many currencies and different correlations. For more information, consult the article on the label filter.

Testing and Optimization: Test strategies within cTrader using historical data to evaluate their effectiveness. Optimize algorithms based on test results to improve performance.

Real-Time Monitoring: Continuously monitoring strategies and periodically retesting them is crucial for optimizing algorithmic trading. Evaluate the performance of strategies based on market evolution and trading objectives.

Conclusion Currency correlations offer valuable insights for forex trading, allowing for portfolio diversification and risk reduction. Using AlgoBuilderX, traders can develop and implement strategies based on these correlations effectively and automatically, without needing to know how to program. Staying updated on currency correlation dynamics and adapting strategies accordingly is essential for success in the forex market.