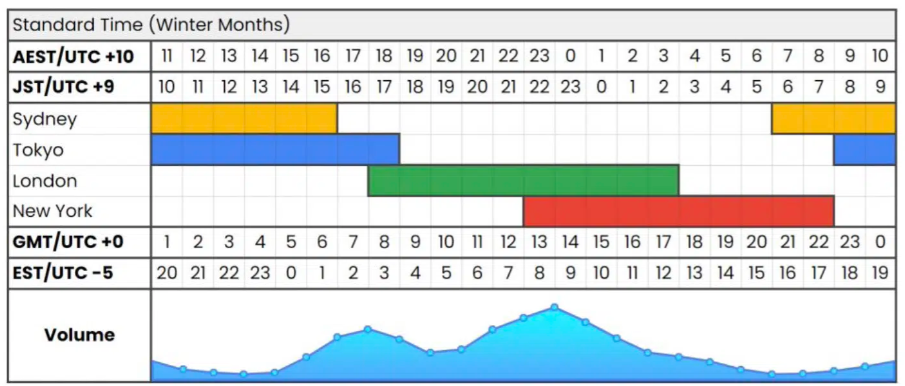

The Forex market, operating 24/7 across the four main trading sessions—Sydney, Tokyo, London, and New York—provides a continuous flow of opportunities. However, to maximize profits, traders need a thorough understanding of peak volatility times and strategic planning, especially when using algorithmic strategies.

The Four Major Forex Trading Sessions

Each trading session has unique characteristics in terms of trading volume and influential currency pairs. Here’s an overview of the four primary sessions, with times adjusted for GMT +0:

- Sydney Session: Opening the trading day, this session is particularly suited for AUD and NZD pairs. With moderate volatility, it provides a calmer environment ideal for initial strategies.

Hours (GMT +0): 21:00 – 06:00 - Tokyo Session: Volatility increases with the Asian session, creating an ideal window for trading currencies like JPY. Tokyo brings increased market activity, offering more substantial movement opportunities than the Sydney session.

Hours (GMT +0): 23:00 – 08:00 - London Session: One of the most active sessions with high trading volumes, especially influential for EUR, GBP, and CHF. Investors favoring short-term strategies find this session ideal due to its high volatility.

Hours (GMT +0): 08:00 – 17:00 - New York Session: The final session to close, featuring strong USD involvement and heightened volatility, especially during the London-New York overlap—one of the day’s most intense trading periods.

Hours (GMT +0): 13:00 – 22:00

These times are based on Greenwich Mean Time (GMT +0). The volatility peaks during these sessions create excellent opportunities to strategically align trading activities, especially during session overlaps such as London-New York, which typically offers the highest volatility.

Session Overlaps: Prime Trading Opportunities and Increased Volatility

Overlapping sessions, such as the London-New York overlap, produce high-volatility periods that suit fast-paced strategies like scalping and day trading. The Sydney-Tokyo overlap, while less intense, offers good opportunities for trading Asian currencies, ideal for investors focused on this region.

AlgoBuilderX: The Perfect Support for Algorithmic Trading

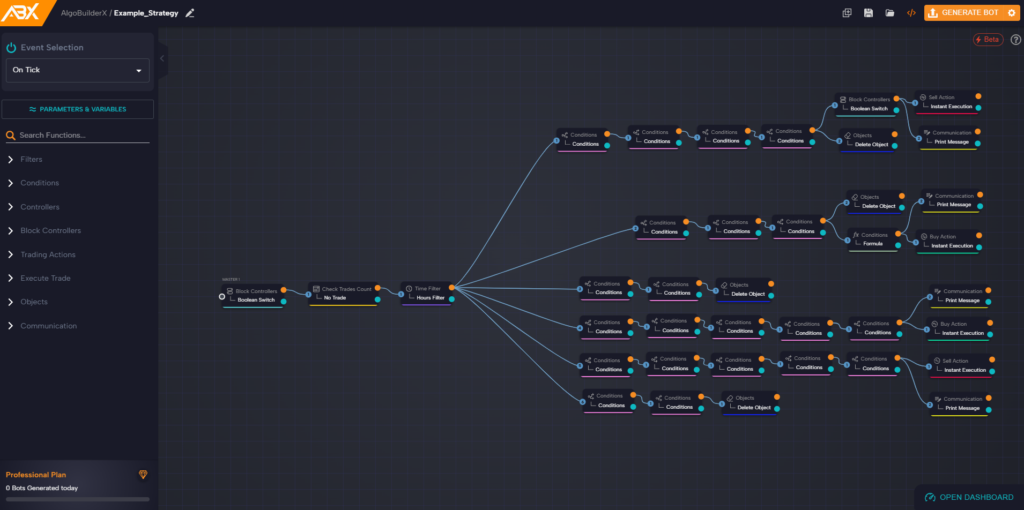

With the rise of algorithmic trading, cBots enable traders to exploit key market moments. They can be programmed to automatically enter the market during specific sessions or overlaps, focusing on London-New York volatility or the initial momentum of the London session.

AlgoBuilderX equips algorithmic traders with advanced tools to create strategies aligned with each session’s unique rhythms and characteristics. This enables them to:

- Execute Scalping Strategies: Thanks to fast cBot execution, traders can capitalize on the volatility of session overlaps.

- Optimize Swing Trading: Concentrating on session openings, cBots can identify and leverage predictable price movement patterns, ideal for long-term trends.

Integrating AlgoBuilderX for Optimal Returns

AlgoBuilderX offers powerful tools for creating strategies tailored to each trader’s preferences, automating operations at favorable times and responding in real-time to market changes. The platform helps reduce monitoring time and boost operational efficiency by offering:

- Customizable Strategies: Traders can target specific currency pairs and high-volatility times, maximizing profit potential.

- Tailored Optimization: With AlgoBuilderX, traders can implement custom strategies adapted to market conditions and hourly volatility, enhancing performance to match their operational needs.

Why Choose AlgoBuilderX?

AlgoBuilderX provides advanced support for algorithmic traders looking to leverage Forex market sessions. With tools that react to real-time fluctuations, AlgoBuilderX is an essential resource for strategic, efficient trading without sacrificing execution speed.

With Forex trading available around the clock, choosing the right times to enter the market is crucial. Harnessing AlgoBuilderX to align strategies with session times ensures optimal risk management and a higher chance of success.