1. Introduction

Algorithmic trading allows traders to automate complex strategies, respond quickly to market fluctuations, and enhance decision-making efficiency. A winning algorithmic trading system requires a solid strategy and advanced tools for implementation. With AlgoBuilderX, traders can easily build, test, and manage trading systems without any programming knowledge.

2. Defining the Strategy

Choosing the right strategy is the first crucial step in building an algorithmic trading system. In Forex and CFD trading, common strategies include:

- Trend-Following: This strategy follows the prevailing market trend, buying when prices are rising and selling when they are falling.

- Mean Reversion: It’s based on the idea that prices tend to revert to a historical average. When the price deviates too much from this average, a return is expected, allowing traders to buy low and sell high.

- Range Trading: This strategy operates in sideways markets where prices fluctuate between support and resistance levels. Traders take advantage of these oscillations by buying at support and selling at resistance.

These strategies can be customized and automated using AlgoBuilderX, making it easy to test and implement them.

3. Developing the System

The algorithmic trading system must include well-defined entry and exit signals, along with rules for position and risk management. AlgoBuilderX simplifies the development process for less experienced traders with its intuitive drag-and-drop interface, allowing complex strategies to be built without coding.

- Entry/Exit Signals: Clearly define criteria for opening and closing positions by taking advantage of numerous conditions.

- Position Management: Determine position size based on capital and risk.

4. Risk Management

Effective risk management is vital for trading success. AlgoBuilderX offers advanced risk management tools such as:

- Breakeven: Moves the stop loss to the entry price once the market reaches a certain profit level.

- Trailing Stop: Automatically adjusts the stop loss as the price moves in the favorable direction.

- Advanced Take Profit: Allows multiple take profit levels to manage partial exits effectively, maximizing gains.

With AlgoBuilderX, these advanced risk management functions are easy to implement and customize.

5. Backtesting and Optimization

Backtesting is a critical phase in building a successful algorithmic system. It allows you to test the strategy on historical data to ensure it works before deploying it in a live environment. cTrader, the platform supported by AlgoBuilderX, offers powerful backtesting tools, allowing traders to simulate strategy results on past data and optimize parameters to improve performance.

Forward testing, conducted on a demo account in real-time, is the next step to confirm the strategy’s effectiveness under current market conditions.

6. Monitoring and System Updates

Once the system is up and running, it is important to monitor its performance. Markets are constantly changing, so a winning algorithmic system must be constantly adapted and improved.

- Real-time Monitoring: With cTrader’s cBot Cloud Execution, you can run up to 10 cBots simultaneously on cTrader’s servers, continuously monitoring your systems.

- Updates and Changes: AlgoBuilderX allows you to quickly update and change your system without interruption, ensuring that you are always one step ahead of the market.

7. Case Study: Examples of Algorithmic Systems Built with AlgoBuilderX

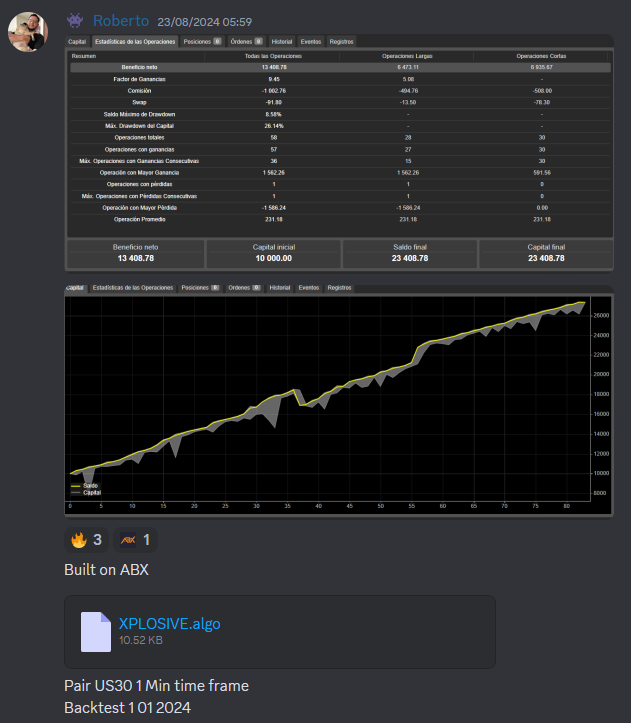

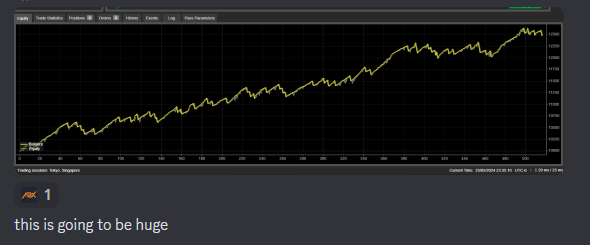

Many traders have already created profitable algorithmic systems within our Discord community using AlgoBuilderX.

Over time, these systems have been optimized through backtesting and simulations on cTrader, with successful results shared within our community.

Below are some screenshots of backtests performed by our users on cTrader, demonstrating positive performance and the effectiveness of strategies developed with AlgoBuilderX.

8. How to Get Started with AlgoBuilderX

If you’re considering starting with AlgoBuilderX, don’t worry if you have zero knowledge of programming or algorithmic trading. Our platform is designed to be intuitive and accessible even for beginners.

Upon your first launch of AlgoBuilderX, you’ll be greeted with a guided tutorial featuring simple introductory videos. These tutorials will walk you through the basic functions and key features of the platform, helping you become familiar with the tools at your disposal.

After completing the initial tutorial, you can deepen your knowledge through our free Academy. Visit our website at AlgoBuilderX Academy to access additional resources, courses, and guides that will help you make the most of our platform.

Getting started with AlgoBuilderX is straightforward and stress-free, thanks to the ongoing support we provide. Good luck and happy trading with your algorithmic projects!