The world of trading is constantly evolving, and prop firms are becoming an increasingly popular choice for traders who want to expand their earning opportunities without investing large initial capital. One of the most effective strategies for maximizing profits and minimizing risks is the use of expert advisors (EA or cBot). In this article, we will find out why it is essential to have a custom expert advisor when operating with prop firms and how AlgoBuilderX can facilitate the creation of these powerful trading tools.

What is a Prop Firm?

Prop firms, or proprietary trading firms, are companies that allow traders to use the firm’s capital to trade in exchange for a share of the profits. This model offers numerous advantages, including access to larger capital, continuous training, and advanced trading infrastructure. However, to succeed in a prop firm, it is crucial to have solid and efficient trading strategies, and this is where expert advisors come into play.

Advantages of Using an Expert Advisor in a Prop Firm

- Automation of Trading Strategies: EAs allow the automation of trading strategies, executing trades based on predefined criteria without human intervention. This reduces the risk of errors due to emotions or distractions, improving trading efficiency.

- Time Saving: Using an expert advisor allows traders to free up valuable time. EAs can monitor markets and execute trades 24/7, enabling traders to focus on other activities such as analyzing new strategies or continuous training.

- Consistency in Operations: EAs follow trading rules to the letter, ensuring greater consistency in operations. This is particularly important for prop firms, where consistency and discipline in trading are essential for long-term success.

- Access to Complex Strategies: EAs can implement advanced and complex trading strategies that would be difficult to execute manually. This can include the use of sophisticated technical indicators and more.

Why it is essential to create your own Expert Advisor

You Own the Source Code: Being able to provide the EA’s source code allows the trader to clearly and transparently demonstrate the strategies used to achieve specific results. This transparency is especially important in contexts like prop firms, where compliance and documentation of strategies are often necessary to ensure regulatory compliance and investor trust

Exclusivity and Transparency: Having a custom EA created with AlgoBuilderX means being the only one to possess it. This provides a unique competitive advantage, as the trader has complete control over the algorithm’s operation and can adapt it to their needs without concerns about sharing or replicability by others.

- Total Control Over Trading Strategies: Accessible source code allows the trader to fully understand how the EA operates and make changes or updates based on evolving market conditions. This level of control is crucial for quickly adapting to changing trading dynamics and maximizing profit opportunities.

How AlgoBuilderX Can Help You

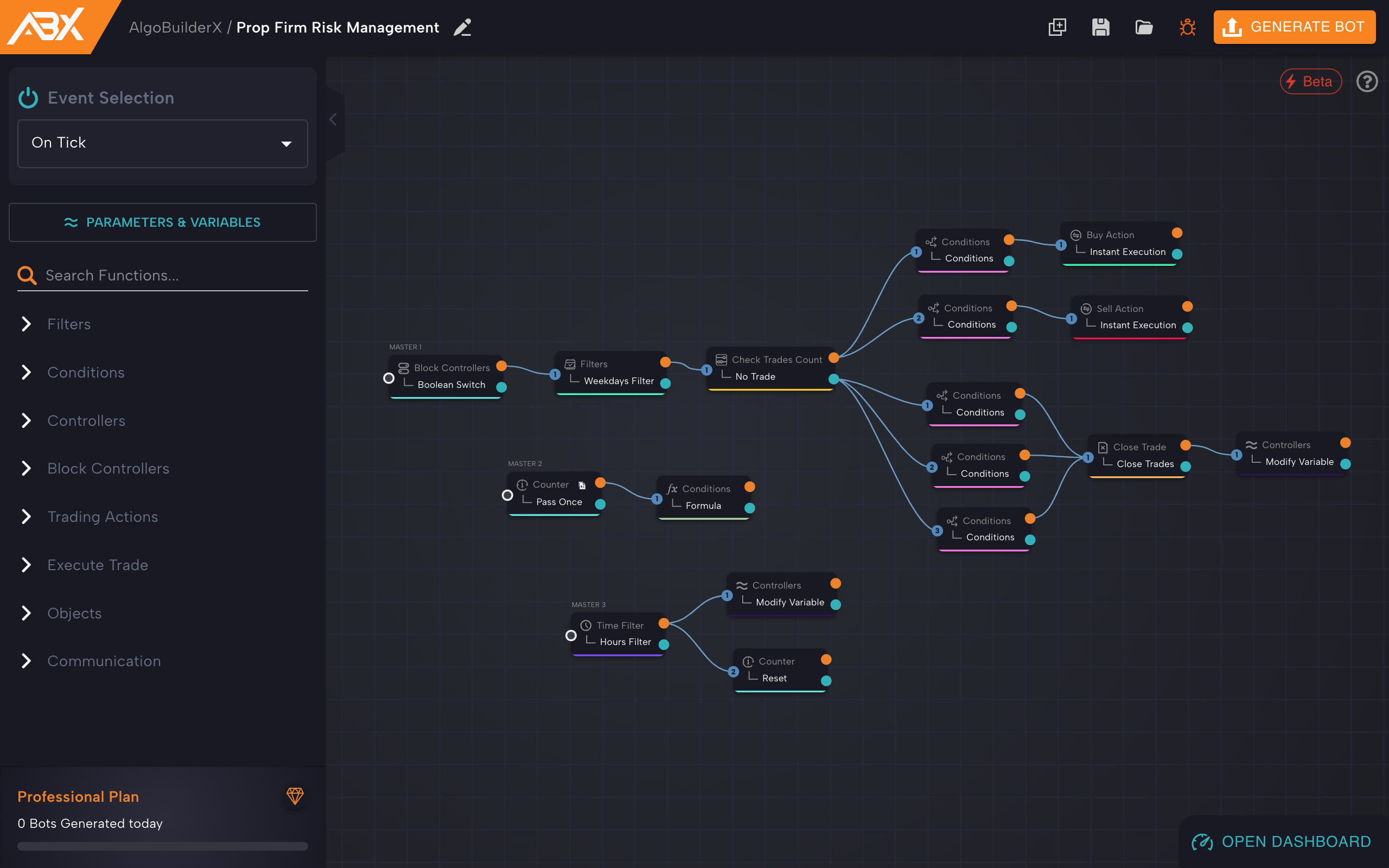

AlgoBuilderX is an innovative platform that allows you to create expert advisors without writing a single line of code. Here’s how AlgoBuilderX can make life easier for traders, especially those operating within prop firms:

– Ease of Use: AlgoBuilderX uses an intuitive drag-and-drop interface that makes creating cBots simple and accessible to everyone, regardless of experience level. This means that even traders with no programming knowledge can develop sophisticated expert advisors.

– You Get the Source Code: With AlgoBuilderX’s Professional Plan, you get access to the source code of your created cBots ensuring uniqueness and greater confidence in the event of inspections by the Prop Firm.

– Customization and Risk Management: With AlgoBuilderX, you can create cBots that allow you to apply effective risk management, suitable for prop firms. It is possible to implement tools such as Equity Stop Loss, an Equity Target, a Daily Target, and choose whether or not to trade on Fridays.

We have created a video tutorial on how to implement these risk management features with AlgoBuilderX. You can find the video at this link: Video Tutorial.

– Support and Resources: AlgoBuilderX provides educational resources and community support to help users maximize the platform’s potential. The AlgoBuilderX community is active and ready to provide tips, share strategies, and solve issues.

Prop firms offer traders the opportunity to access larger capital and advanced infrastructure, but success in this competitive environment requires solid and efficient trading strategies. Expert advisors are a powerful tool for automating and optimizing trading strategies, and AlgoBuilderX makes creating these tools accessible to everyone.

Visit AlgoBuilderX to discover how this platform can help you develop effective expert advisors and improve your trading performance within a prop firm. With AlgoBuilderX, the power of algorithmic trading is at your fingertips, allowing you to focus on what matters most: trading success.