In the world of algorithmic trading and quantitative strategies, Walk-Forward Optimization (WFO) is an advanced backtesting technique that helps test and improve the robustness of a trading system. Invented by Robert Pardo, this method, detailed in his 1992 book “Design, Testing, and Optimization of Trading Systems,” helps to avoid common mistakes like overfitting and offers a more realistic evaluation of a strategy’s future performance.

What is Walk-Forward Optimization?

Walk-Forward Optimization is an iterative process that divides historical data into two main periods:

- Optimization Period: where the strategy is trained and optimized.

- Walk-Forward Period: where the strategy is tested to assess its effectiveness on unseen data.

This process is repeated by progressively moving the data window forward in time, hence the term “walk-forward.”

How Does the Process Work?

The Walk-Forward Optimization process can be summarized in these key steps:

- Data Splitting: Historical data is divided into an optimization window and a testing window. For example, over 10 years of historical data, the strategy could be optimized on the first 8 years and tested on the remaining 2 years.

- Optimization: During the optimization period, the goal is to find the best parameters for the strategy that maximize performance (e.g., return or net profit) over that period.

- Walk-Forward Test: Once the optimized parameters are selected, they are applied to the next period (walk-forward) to verify the strategy’s effectiveness on unseen data.

- Repetition: The optimization window is shifted forward in time, the strategy is re-optimized, and tested on the new walk-forward period. This cycle is repeated throughout the entire dataset.

- Overall Analysis: At the end of the process, multiple performance results are obtained for each walk-forward period. The final evaluation is made on the aggregate of these tests, providing a realistic view of the strategy’s future performance.

The Advantages of Walk-Forward Optimization

The main advantage of Walk-Forward Optimization compared to a simple backtest is the reduction of overfitting risk. In traditional backtesting, there is a risk that a strategy fits too well to historical data, making it less effective on future data. This phenomenon, known as overfitting, results in strategies that look promising in backtests but fail in real market conditions.

With WFO, the use of “future” data relative to the optimization period provides a more accurate assessment of a strategy’s robustness. If an optimized strategy performs well on unseen data (not used during optimization), it increases the likelihood that it will maintain good performance in real markets.

Critical Parameters and Configuration Choices

To properly implement Walk-Forward Optimization, several important decisions must be made regarding the configuration:

- Length of the Optimization and Walk-Forward Window: This choice is critical. A window that is too long for optimization may produce outdated results, while one that is too short may not capture long-term dynamics. The walk-forward window should be long enough to assess the strategy’s effectiveness.

- Optimization Metrics: During the optimization process, various metrics can be considered, such as return, drawdown, Sharpe ratio, etc. It is important to choose a metric that reflects your trading goals.

- Number of Walk-Forwards: The number of iterations in the walk-forward process can affect the stability of the evaluation. In general, more walk-forward tests provide a better estimate of the performance.

Practical Example

Let’s say we want to apply Walk-Forward Optimization to a moving average crossover trading strategy. We have 10 years of historical data and decide to optimize the strategy on 3 years and test it on 1 year. The process is as follows:

- Optimize the parameters (e.g., lengths of the moving averages) on the first 3 years.

- Apply the strategy with the optimized parameters to the following year (4th year).

- Shift the window 1 year forward and repeat the process until covering all 10 years of data.

- Analyze the overall performance across all walk-forward test periods.

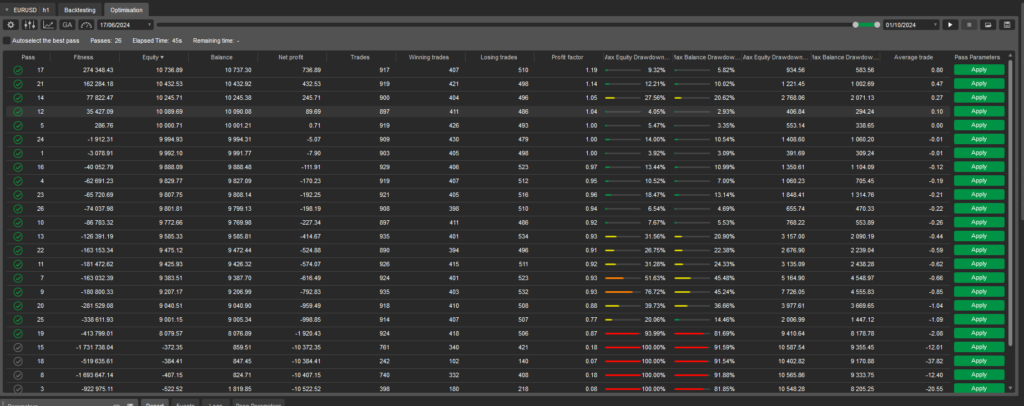

For traders using cTrader, Walk-Forward Optimization can be implemented directly within the platform, allowing for more precise optimization and testing of trading strategies. cTrader offers powerful backtesting and optimization tools, enabling users to simulate strategies on historical data and refine them using techniques like Walk-Forward Optimization. If you’re interested in learning more about how to perform backtests and optimizations within cTrader, you can read our detailed guide here.

Walk-Forward Optimization is an essential tool for traders who want to create robust strategies capable of adapting to market changes without being excessively optimized on past data. When implemented correctly, this technique provides a realistic assessment of future performance and helps mitigate the risk of failure in real markets. However, like any tool, it requires careful configuration and a solid understanding of its dynamics to avoid false confidence and maximize the effectiveness of trading strategies.